- Home

- About Us

- Agreements

- Membership

- Education

- Project Planning for Small Projects

- Bluebeam Basics

- Advanced Estimating Strategies

- Stop Doing, Start Leading

- Remarcable Lunch & Learn

- Enable Success – Alignment of Field & Office

- Analyze Problems and Make Decisions

- Leadership Summit for Managers

- Foreman’s Development Series

- Project Management Training

- Recognition

- Calendar

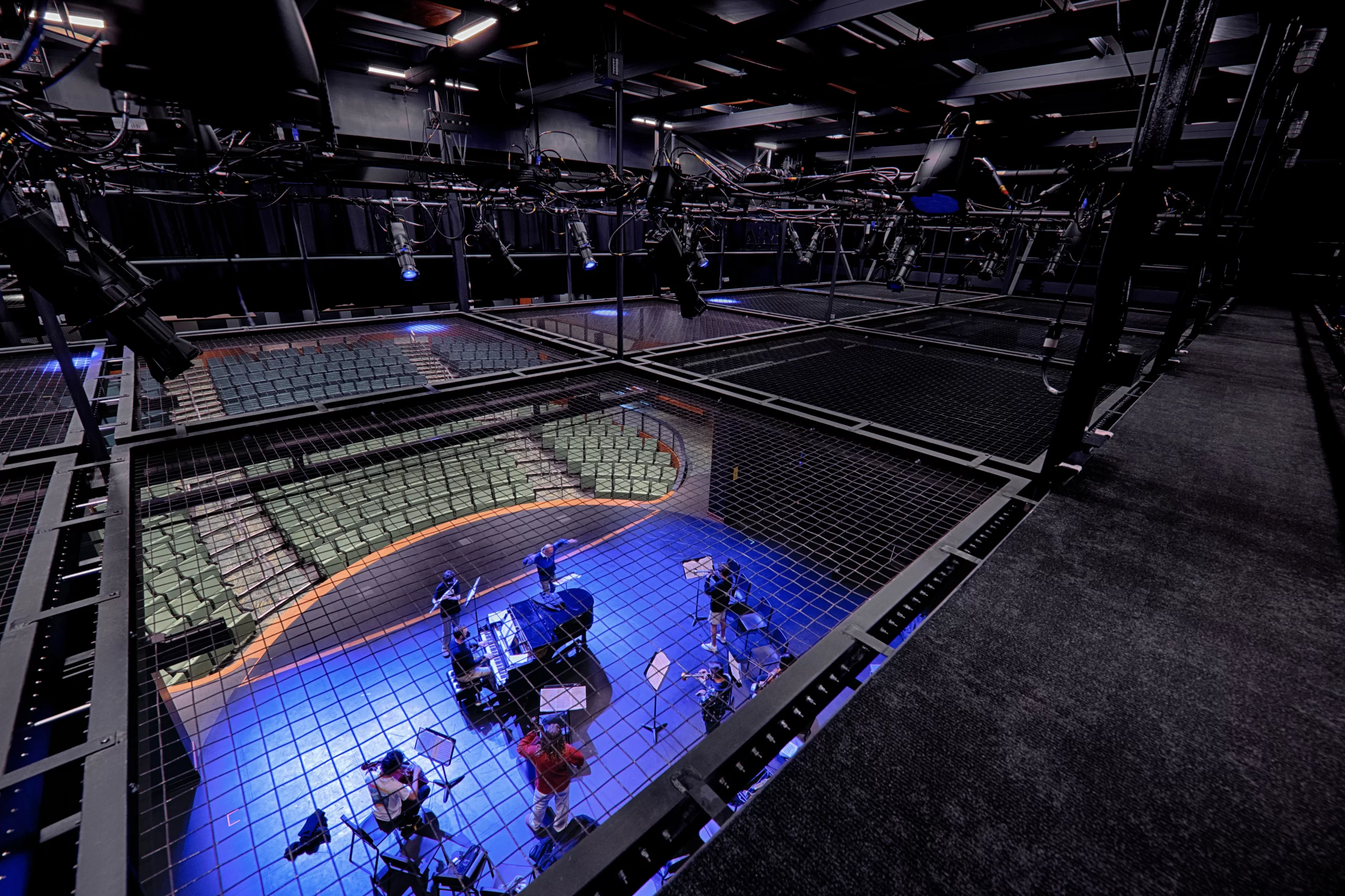

- Photo Gallery

- News

- Contact

NorCal NECA

National Electrical Contractors Association

Northern California Chapter

7041 Koll Center Parkway, Suite 100

Pleasanton, CA 94566

Phone: 925-828-NECA(6322)

Northern California Chapter

7041 Koll Center Parkway, Suite 100

Pleasanton, CA 94566

Phone: 925-828-NECA(6322)

Monday Morning News

Receive updates from NorCal NECA

Receive updates from NorCal NECA

© Copyright 2026. National Electrical Contractors Association, Northern California Chapter.

Another

Never Boring website.